Before searching for property and making an offer it is always recommended to apply for preapproval or conditional approval. A preapproval or conditional approval is subject to certain conditions. This usually speeds up the purchase process for when you actually find the property you wish to purchase. It also gives you greater confidence to make a conditional offer on a property. It also gives you the knowledge of how much you can spend up to.

How do I apply for a Pre-approval?

There are two options to go about this. Firstly, you can deal directly with the bank or you can contact a mortgage broker. The main difference between the two is that banks have a select few products to choose from. A mortgage broker has a panel of lenders to choose from (usually at least 30 lenders) with a wider variety of loan products to choose from depending on your requirements and financial situation. Be aware though when deciding that some of the bigger brokerage companies are owned by the big banks.

What documents will be required from me?

Whichever route you take to apply for a mortgage application you will need to have at least prepared and lodged your most recent tax return and received your notice of assessment. This is usually a non-negotiable. This provides the bank with evidence that your income is consistent. If you were working at a different employer, there is no need to stress as this is still acceptable with majority of lenders as long as you have been in the same industry for over 12 months and not on probation. There are still a few lenders that accept being employed in the probationary period. However, this a case by case scenario and depends on the strength of the deal i.e. other income, savings etc.

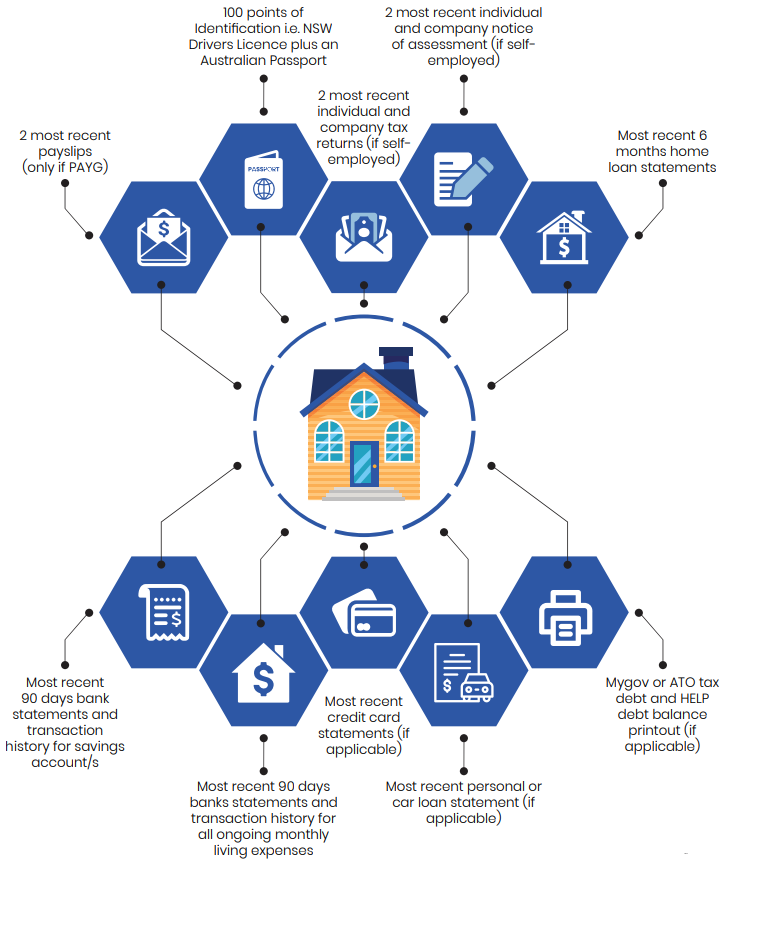

Other than a notice of assessment there are other documents that are also important that need to be provided with the application such as;

All of the above are required items to proceed with an application. Each item supports your case to the lender and your broker/ bank manager represents you. They basically act as a middle man to make sure the process goes as smoothly as possible. In most cases the lender always has more questions and/or requests further documents due to policy changes. This a normal part of the process so do not stress if the lender asks for more information.

I have pre-approval, so what now?

Once you have received pre-approval from the bank you can begin your search for a property and make a conditional offer subject to unconditional approval of loan. The general conditions being funds to complete and a satisfactory independent valuation organized by the lender. This generally can depend on your situation. The lender’s policy and other conditions may be required to be met prior to going forward with the process.

This is the second article of the property purchase series. If you are interested, and would like to learn more. Please click here for the part 3 of this 10 part series on the property purchase process. Please click here for previous post of the series.